- SME Sustainability Hub

- Sustainability Topics

- Sustainability Reporting

- Understanding Sustainability Reporting and Disclosures

Understanding sustainability reporting and disclosures

Understand the benefits of sustainability reporting and the commonly used frameworks for sustainability reporting in Singapore.

Sustainability reporting is an essential practice for businesses to enhance transparency and accountability in their environmental, social, and governance (ESG) performance. The reporting process involves identifying key sustainability metrics, collecting relevant data and presenting it in a structured report that highlights the company's commitment to sustainable development. By systematically documenting and disclosing their sustainability initiatives and outcomes, businesses can experience many positive outcomes.

Benefits of sustainability reporting

1. Key regulatory shifts in sustainability reporting

Globally, the business landscape is changing and ESG regulations are rapidly evolving to address the impact of climate change. In 2022, the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) have set up a Sustainability Reporting Advisory Committee (SRAC) to advise on a roadmap for advancing sustainability reporting in Singapore.

Singapore’s sustainability reporting landscape

Listed and large non-listed companies

In February 2024, Singapore first announced the roadmap for mandatory climate reporting, which will be implemented in a phased approach. In August 2025, the roadmap was updated with extended timelines for implementing climate reporting requirements (including external assurance) to support listed companies and large non-listed companies (Large NLCos) in developing their reporting capabilities. Table below summarises the updated requirements.

Mandatory requirements |

Updated Climate Reporting and Assurance Requirements (announced on 25 August 2025) |

|||

| Listed companies | Large Non-listed companies | |||

| STI Constituents | Non-STI constituent listed companies ≥$1B market cap | Non-STI constituent listed companies <$1B market cap | Annual revenue ≥$1B and total assets ≥$500M | |

| Scope 1 and 2 GHG emissions | FY2025 | FY2030 | ||

| Other ISSB-based climate related disclosures | FY2025 | FY2028 | FY2030 | |

| Scope 3 GHG emissions | FY2026 | Voluntary | Voluntary | Voluntary |

| External limited assurance for Scope 1 and 2 GHG emissions | FY2029 | FY2032 | ||

TIP:

What does this mean for smaller and non-listed businesses?

While not mandated, smaller non-listed companies are encouraged to adopt sustainability reporting practices on a voluntary basis to gain competitive advantage in an increasingly sustainability-conscious business landscape.

2. Get to know the commonly-used sustainability reporting standards and frameworks

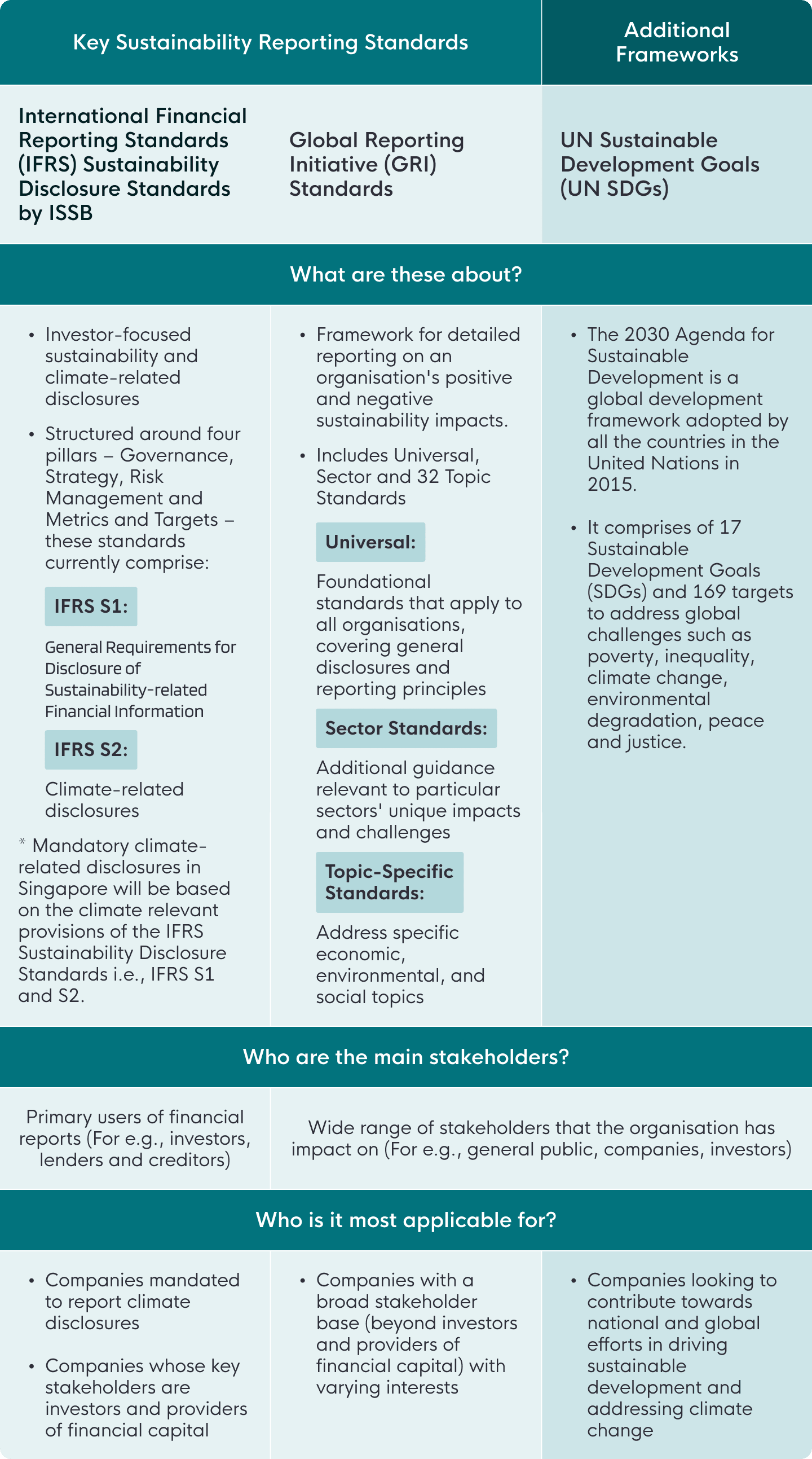

Sustainability reporting standards and global frameworks can set the foundation for a company's disclosures. There are several sustainability reporting standards and frameworks used internationally, each with a different focus, such as investor versus multi-stakeholder focus, and ESG versus climate focus. Businesses can adopt more than one standard if necessary to suit their reporting purposes and meet stakeholder expectations. Additional details on common sustainability reporting standards and frameworks can be explored below.

Examples of commonly-used sustainability reporting standards and frameworks:

Which are the reporting standards and frameworks commonly used by Singapore businesses?

Based on a 2023 study by the Centre for Governance and Sustainability (CGS) at NUS Business School and Singapore Exchange Regulation (SGX RegCo), the GRI Standards were the most popular reporting standards adopted by Singapore issuers, followed by the Task Force on Climate-related Financial Disclosures (TCFD), which has been incorporated into the IFRS Sustainability Disclosure Standards, and the United Nations Sustainable Development Goals (UN SDGs).

- 99.8% of SGX-listed issuers have utilised the GRI Standards.

- For climate-related disclosures, the TCFD recommendations (now incorporated into the ISSB Standards) was adopted by 73% of issuers in their reports.

- The UN SDGs came in as the third most popular framework with 42% of listed issuers committing to achieve some of the goals.

TIP:

The IFRS Sustainability Disclosure Standards by ISSB is expected to gain traction in Singapore, driven by the mandates from SGX RegCo and ACRA. As companies place greater emphasis on enhancing their sustainability reporting, the adoption of these standards is anticipated to increase further.

3. ESG ratings and rating providers

In addition to publishing their sustainability performance within sustainability reports, businesses are often evaluated and assessed on their ESG performance by third-party data providers such as ESG rating agencies.

What are ESG ratings and what are they used for?

An ESG rating provides an indication of how well a company is managing its environmental, social, and governance risks and opportunities, in comparison to its industry peers. ESG ratings are used to supplement conventional financial analysis, and help in assessing potential risks and opportunities of a business.

Institutional investors, asset managers, financial institutions and other stakeholders are increasingly relying on ESG ratings to assess and measure a company's ESG performance over time and in comparison to peers.

What are some challenges of adopting ESG ratings?

While ESG ratings are determined by rating agencies, the current industry suffers from a lack of harmonisation due to the fragmented practices across rating agencies and regulatory oversight. Hence, there is currently no standard approach to date, as rating agencies adopt different methodologies, scopes and coverage in their respective assessments.

What should businesses consider when adopting an ESG rating?

In 2023, the Monetary Authority of Singapore (MAS) published its finalised Code of Conduct for ESG Rating and Data Product Providers (“CoC”). The CoC aims to establish baseline industry standards for transparency in methodologies and data sources, governance, and the management of conflicts of interest that may compromise the reliability and independence of the products. To enable businesses to easily identify providers that have publicly adopted the CoC, MAS has worked with the International Capital Market Association (“ICMA”) to host a list of such providers on ICMA’s website.

Writing a sustainability report

Understand the key components of a sustainability report and practical steps to write your first report.